An initial assessment of the extent of inefficiency in electricity trade

Electricity interconnectors transport power from countries with low prices to countries with high prices. In doing so, they reduce the overall cost of meeting electricity demand. However, given electricity prices are volatile, making sure interconnectors are flowing the right way is complicated.

EU legislation sets out a harmonised process to maximise efficiency. But post Brexit, GB is no longer part of it. Below, we provide an early assessment of how this has impacted the efficiency of interconnector flows, concluding that the lost value of interconnector trade might be of the order of £45m per annum.

Before and after

Prior to 1 January 2021, capacity allocations and flows on the electricity interconnectors between GB and continental Europe (and those with Ireland and Northern Ireland) were determined under European legislation. This meant that the GB market was part of the Europe-wide Single Day Ahead Coupling (SDAC).

The SDAC process involved collecting the prices at which generators, traders and retailers wanted to buy and sell power in across the EU. This data was used to calculate competitive market prices in each country and at the same time to work out which way interconnectors should flow. It was designed to ensure that interconnector capacity is used in the most efficient way possible, maximising the transfer of electricity from lower priced areas to higher priced areas.

Before this process, many interconnectors were allocated using so-called explicit auctions (the SDAC process is often referred to as an implicit auctioning process). But explicit auctions were widely recognised to be inefficient. This is because to move power between systems required both the purchase (and sale) of power, and the separate purchase and use of interconnector capacity. Under SDAC, this all happens simultaneously, which is the key source of efficiency gain.

With the end of the Brexit transition period, GB interconnectors have returned to an explicit auction process. So now, to move power between GB and NL using the Britned cable:

- traders buy interconnector capacity in an auction held between 0850 and 0910 each day;

- traders then buy or sell power in GB on EPEX (auction bids close at 09.20 GMT) or N2EX (which closes at 09.50 GMT), and then separately in the Netherlands at 11.00 GMT; and

- traders can nominate to flow power to deliver on their trades using capacity they have bought on Britned between 10.30 GMT and 13.30GMT.

This means that traders are contemplating buying a right to capacity to flow electricity between GB and the Netherlands before the electricity price in either GB or the Netherlands is known. Yet the efficient price of interconnector capacity is driven by the power price spread between the two countries. So traders run the risk that they get their forecast of the price differential wrong when they bid for interconnector capacity (for example, undervaluing capacity). And society runs the risk that interconnector capacity is under-used.

How much does it matter?

The chart below shows the relationship between power flow over the GB-France interconnector (IFA1) and price differences between GB and French day ahead markets before Brexit. It shows that, as soon as prices diverged by a small amount, the interconnector was typically fully used to move power from the low price to the high price region.

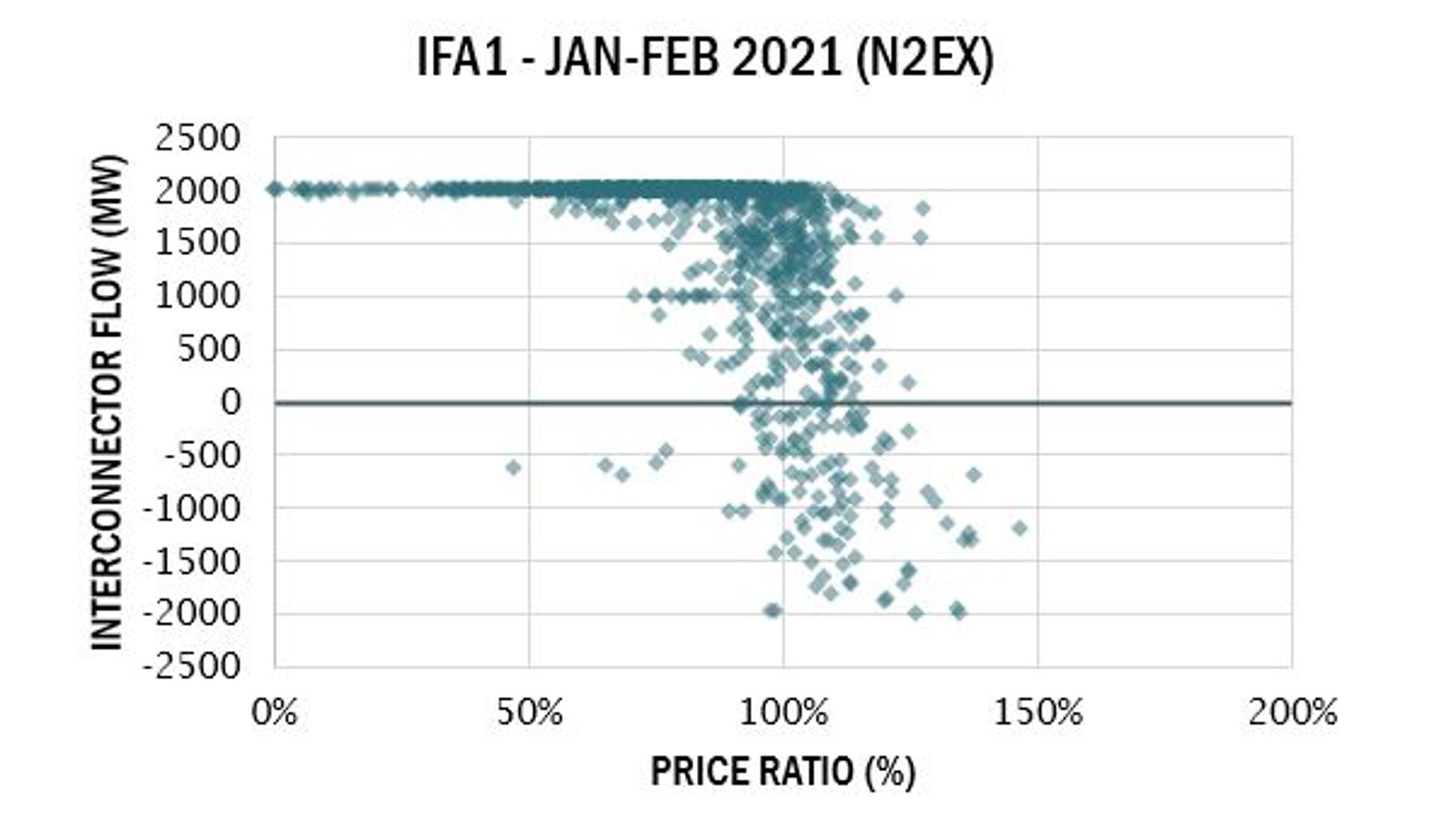

This second chart shows the relationship after Brexit. The pattern is clearly significantly more random, with interconnector capacity being left unused on plenty of occasions, despite there being material price differences.

We have estimated the lost gains from trade as a result of the failure to exploit the full capacity of IFA1 in January and February, and then scaled it up across all interconnectors and over the whole year. On this basis, we estimate a lost value of trade of £45m, although clearly given our simple approach there are a number of assumptions implicit in this valuation.

Where do we go from here?

The EU-UK Trade and Cooperation Agreement suggests a replacement process for determining flows on the interconnectors, and suggests a timeline for the assessment of this process (foreseeing its implementation within 15 months of the start of 2021, subject to a cost-benefit analysis). This process (so-called “loose volume coupling”) was used on some European borders before the advent of SDAC. From an efficiency point of view, it should be better that explicit auctions, but not as good as SDAC.

Our simplistic analysis indicates that the absence of efficient arrangements on the interconnectors does have a material cost. On that basis, even if they are not as efficient as those that operated pre-Brexit, the sooner the arrangements are improved the better.