The popular saying goes, "He who seeks, finds." Is this an exception when it comes to well-remunerated term deposits in Spain?

In recent months, the apparent lack of return on savings is one of the most debated factors in the banking sector, both in Spain and in other countries. The Minister of Economy, Nadia Calviño, has pointed out that "the Spanish banking sector needs to start passing on the interest rate hikes to the savings of Spaniards" and has requested the National Commission for Markets and Competition (CNMC) to investigate whether there are factors affecting banks' incentives to reward deposits. Faced with the belief of insufficient remuneration for deposits, authorities are considering the possibility of making legislative changes to increase savings profitability.

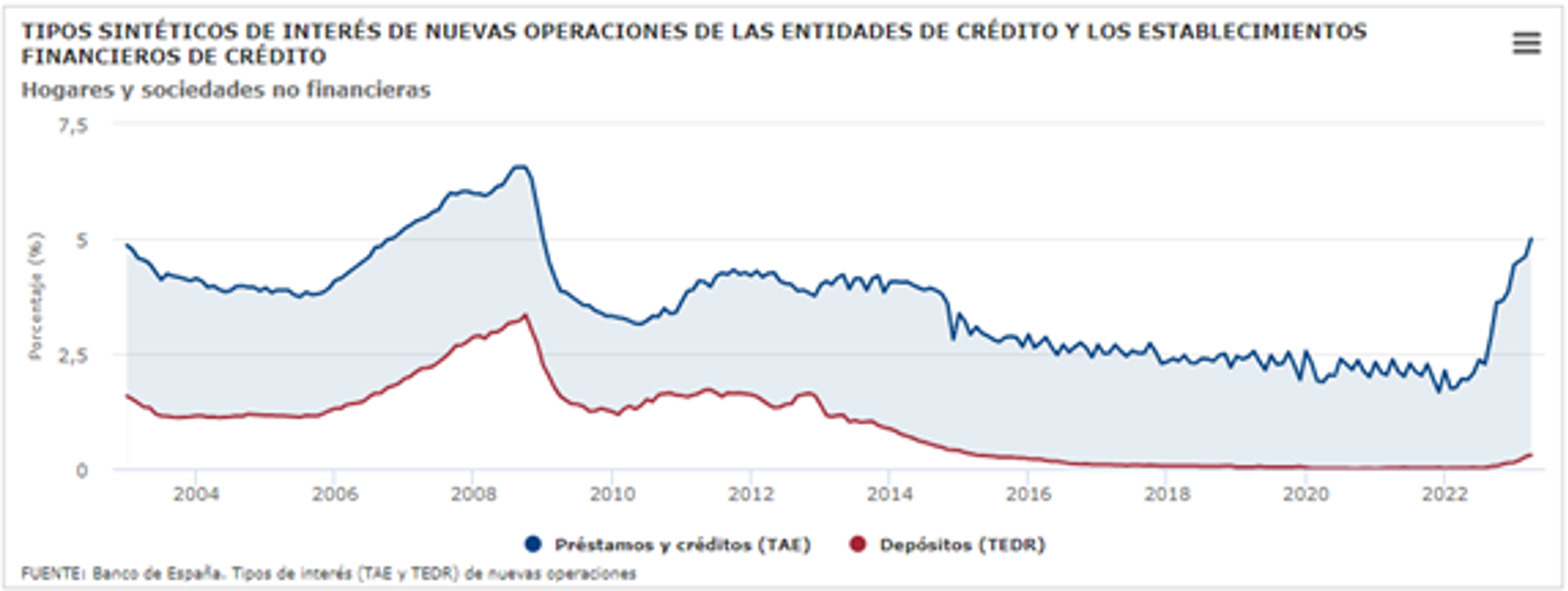

This concern has been justified on certain aggregated data: the observed difference (in series provided by the Bank of Spain) between the average rates charged on new loans compared to new deposits, with this difference reaching a historical maximum.

Bank of Spain’s data on average rates for new Loans (blue line) vs. new deposits (red line)

Source: Bank of Spain

However, drawing conclusions about the functioning of a market by only looking at two series of aggregated data is not sufficient. Bank of Spain's data is a simplification, a difference between synthetic measures of compensation for new loans and deposits, and a result of the behaviours of providers and customers regarding different products and needs.

Could this data reflect a partial view of reality? How much is a reasonable gap to consider that there are no problems in the market? Is the behaviour and level observed in 2008 - where deposits and loans moved together - a good reference point, or has the situation changed since then? Should the pricing of banking products be considered separately, or is it necessary to consider the interrelationships between them? These are some of the multiple questions we should ask ourselves to explore what is happening.

In this article, it is not possible to analyse these questions in detail, but I would like to draw attention to some issues that may be important and deserving of more time.

The current Spanish mortgage market is different from that of 2008

If we analyse the evolution of this synthetic indicator, it seems that the gap widens when comparing the compensation demanded for new mortgages with that offered for new deposits, but this is not the case for other types of loans (consumer loans, credit cards, etc.). However, the Spanish mortgage market has changed significantly in recent years, and there may be multiple elements at play in this result. Currently, approximately 60% of contracted mortgages have fixed or mixed interest rates, while in 2008, 95% of mortgages were granted at fully variable rate. The costs associated with this product may have changed and may be justifying, at least partially, this larger gap. On the other hand, could there also be an impact due to refinancing and renegotiations aimed at alleviating the burden on more vulnerable segments?

How we invest our savings has also changed

The composition of where savings are held also appears to have changed compared to the 2008 picture. Currently, 90% of bank deposits are in accounts with total availability, while in 2008, this percentage was closer to 40%, with 60% being held in fixed-term deposits. Additionally, a relevant portion of household savings may be invested in other investment products, such as treasury bonds or off-balance sheet products (such as investment funds or pensions plans), thanks to the active commercial strategy performed by banks in recent years to increase commissions. Could this change in composition affect the analysis?

Scarcity conditions the price

We know that the "price" of goods and services is related to their cost, scarcity, and level of demand. Is it possible that these factors have changed compared to previous historical moments and are conditioning the reasonable "gap" that exists currently? Could it be that deposits are no longer as scarce (and therefore not as valued) as they were in 2008? This is one of the arguments put forth by banks. Gonzalo Gortázar, CEO of CaixaBank, pointed out that "the credit portfolio has decreased compared to deposits, leading to a surplus of liquidity." (free translation) Similarly, Onur Genç, CEO of BBVA, also referred to the excess liquidity as a determining factor in this situation: "What is scarce is credit, that's why attractive interest rates are offered, and there is much competition. This is not the case with deposits due to the excess liquidity." (free translation)

Non-cognitive factors such as intention-action gap, status quo, or lack of attention

In addition to these elements, there are likely non-cognitive factors influencing the demand and how customers invest their savings. Paradoxically, it doesn't take more than 10 minutes to quickly search the internet and find attractive and low-risk offers to place our savings. In addition to the possibility of investing in treasury bonds, there are many platforms, and even the Consumers and Users Organization (OCU) identifies offers from European and Spanish entities with yields close to 3.5% - 4% APR for a one-year deposit (€10,000). Attractive offers for customers willing to move their savings or salaries to other institutions can also be found on some bank's websites.

However, changing banks or opening a new bank account may have non-financial costs for consumers. Certain surveys indicate that 16% of customers consider opening a new account at another bank likely, but how many of these intentions turn into actions? We know that there is often a gap between intention and action and that what we say is not always a reliable indicator of behaviour. How many customers are actually contracting these available offers in the market? How many are waiting for their bank to offer them something? Or are they simply not even thinking about this issue?

The need for in-depth analysis, from an economist's perspective

Prudence should prevail before implementing legislation that limits companies' ability to determine the prices of the goods or services they offer. Such an approach can generate negative effects on supply, as is the case with other sectors such as housing. It is a short-term solution that addresses the current outcome but not necessarily the root of the problem, and it can have consequences not only on the transmission of monetary policy (as well indicated by the European Central Bank) but also on the flexibility of financial institutions to manage their sources of funding, with more far-reaching consequences for the industry.

Before intervening in the market price, it is necessary to understand the factors underlying the observed results. These elements can be both supply and demand-related and may also be linked to non-cognitive determinants of customer decisions. Are we capable of seriously addressing this issue in Spain and investigating whether there is indeed a problem and, if so, what are the elements causing it? It is essential to promote a better understanding of market factors and customer decision-making to implement effective solutions (if necessary) and increase the well-being of everyone.